The hedge fund maturity curve: From idea storage to institutional intelligence

For hedge funds, much of the investment edge comes from the ongoing refinement of ideas: the incremental updates, internal debates, and shifts in conviction that occur as new information is evaluated. When those research steps are not fully captured, organizations lose visibility into how decisions were formed and why they unfolded the way they did.

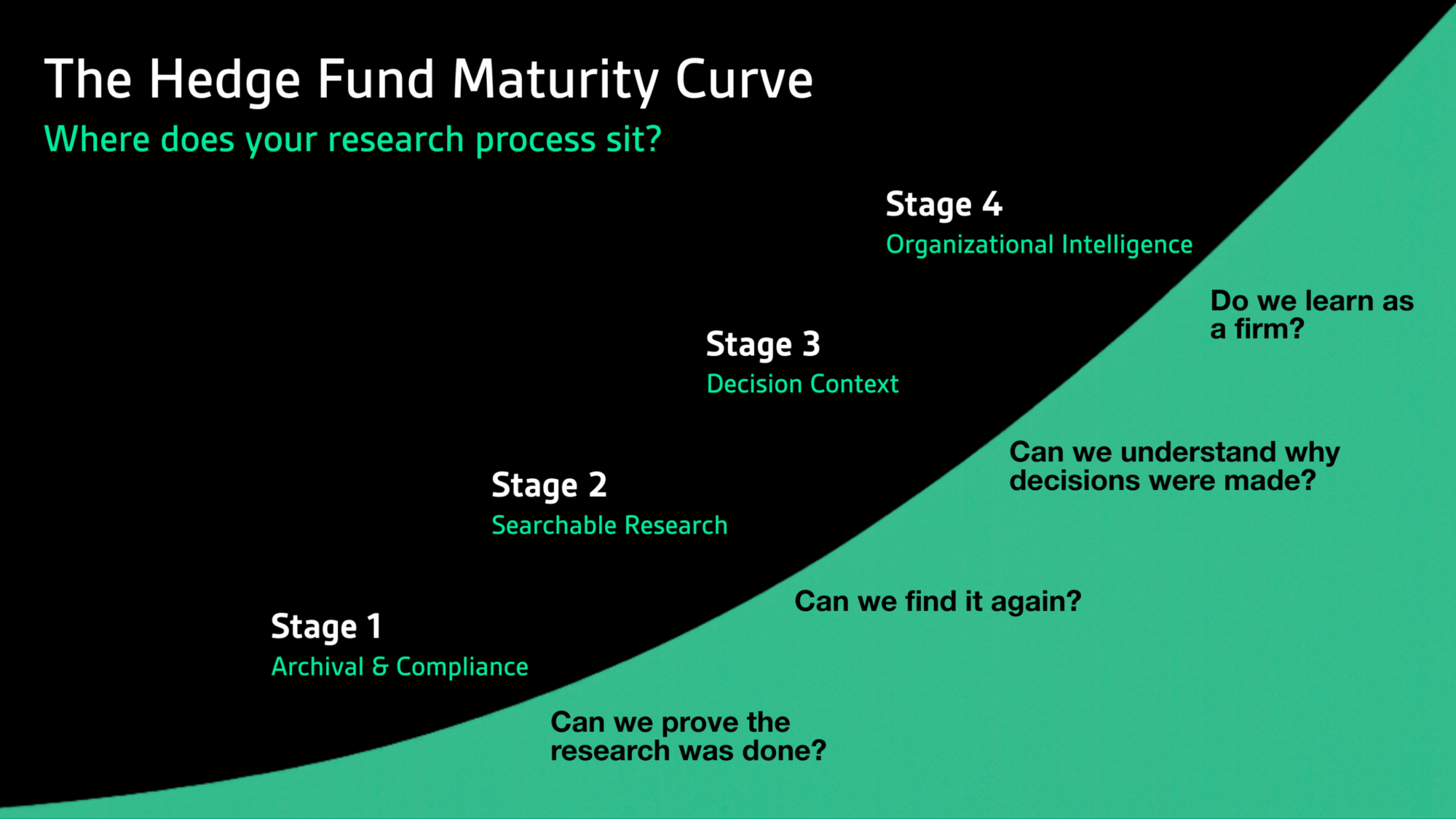

The Hedge Fund Maturity Curve offers a framework to help firms understand how research moves through the organization today, surfacing blind spots and improvement opportunities while assessing whether current workflows can support future growth. Most organizations don’t fit cleanly in one stage; many exhibit characteristics of multiple stages at the same time.

By reflecting on where your firm falls along the curve, leaders can better prioritize process‑improvement investments and concentrate their efforts where they will create the greatest impact, both for the organization itself and in demonstrating value to current and prospective LPs.

Below we outline each stage in detail with its key characteristics, common limitations, and what firms can expect as they move to the next stage.

Stage 1: Archival & Compliance

Primary question: Can we prove the research was done?

At Stage 1, the process functions primarily as a digital filing cabinet, but spread across multiple locations. Analysts conduct research in Word, Excel, OneNote, email, etc. and upload documents after the fact.

What this stage gets right:

- Document storage

- Compliance visibility

- Reduced regulatory risk

Where it falls short:

- Fragmented research records

- Reasoning and evolution of thought are rarely captured

- Context degrades quickly over time

While Stage 1 addresses a core operational need, firms here tend to preserve research outputs rather than the thinking behind them. As scale increases, fragmented insights cannot convey the full story needed to support transparency, defend decisions, or demonstrate consistency to internal and external stakeholders.

What drives the next stage: the need to retrieve prior research efficiently.

Stage 2: Searchable Research

Primary question: Can we find it again?

Stage 2 systems improve accessibility by centralizing research into a single system of record. Instead of research being scattered across emails, personal folders, and slide decks, everything is captured in one place where it can be consistently organized, tagged, and retrieved. Research becomes searchable because it is stored in a unified repository with standardized metadata and structure.

What this stage gets right:

- Better organization and metadata

- Faster retrieval of prior research

- Less repeated work

Where it falls short:

- Decisions still occur outside the system

- Search surfaces what was written, not why

- Post-mortems depend on memory rather than evidence

Many firms believe they’ve reached maturity here. In practice, this is often where progress stalls, because search alone does not preserve conviction, rationale, or debates that influenced the investment.

What drives the next stage: the inability to conduct truly evidence‑based post‑mortems because the underlying rationale isn’t easily accessible.

Stage 3: Decision Context

Primary question: Can we understand why decisions were made?

Stage 3 marks the inflection point where firms shift from documentation to learning. A firm moves beyond centrally storing research to embedding investment workflows directly into the system. Pipeline workflows ensure that ideas, discussions, assumptions, revisions, and decisions are all captured as part of a structured process that keeps stakeholders informed and moves work forward.

What this stage enables:

- Clear linkage from idea → research → discussion → action

- Original assumptions tied directly to outcomes

- Faster onboarding and continuity as roles change

Teams gain the ability to retrace their thinking years later, enabling the investment process to compound rather than reset with each personnel change.

What drives the next stage: the realization that accumulated context can be analyzed, not just preserved.

Stage 4: Organizational Intelligence

Primary question: Do we learn as a firm?

Stage 4 platforms transform the captured workflows of Stage 3 into analyzable intelligence. Because decision context is consistently recorded and connected, the system can surface patterns across cycles, teams, and market regimes. This is where the platform becomes a decision‑support engine: identifying behaviors, detecting biases, reinforcing best practices, and making insights actionable across the organization.

What this stage delivers:

- A fully structured and analyzable investment idea lifecycle

- Pattern recognition across decisions and outcomes

- True institutional memory that strengthens with each cycle

Firms at this stage can clearly show how insights progress into decisions, and they do so in a way that aligns with increasing LP expectations for research transparency and operational due diligence.

Why most platforms plateau

Many processes were designed to solve Stage 1 and Stage 2 challenges: storage, compliance, and search. These remain necessary, but they are no longer sufficient for firms competing on insight, speed, and continuity.

Resilient hedge funds fix operations when they break, but they also evolve them when their workflow outgrows tools from a previous stage. It is this proactive evolution that marks maturity.

Where does your process sit?

If your best insights live in emails, spreadsheets, or Word, or if your investment history feels fragmented rather than cumulative, your firm may be operating below its true potential on the maturity curve.

Moving up the curve is ultimately about aligning your research process with how modern teams think, collaborate, and learn.

Firms that capture context and track how decisions evolve are able to turn experience into institutional knowledge that they can clearly demonstrate to current and prospective LPs. That is exactly what Bipsync enables by connecting themes across research and building intelligence that compounds year after year.